From 1 January 2024, it will be mandatory by law to report a Tax Identification Number (TIN) to E-income at skat.dk. TIN reporting will be required for pay periods ending 1 January 2024 onwards. It also includes the January payroll for employees paid in advance.

Companies are currently required to report identification details, such as the name and address of employees (income recipients), to E-income.

From 1 January 2024, the reporting obligation will be extended and companies will have to ask employees living abroad for the TIN they use in their country of residence.

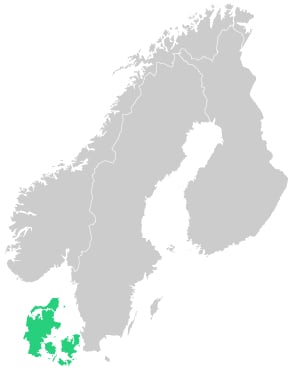

TIN reporting is only relevant for employees who are paid in Denmark but reside outside the country. A TIN number is administered by the employee’s country of residence and is assigned to the employee. The employee must give the number to their employer, who must then report it to E-income.

TIN numbers are used by the tax authorities of individual countries inside and outside the EU to identify a taxpayer. The information will be exchanged with other EU countries via the TIN number, to be able to assess where employees are liable for tax. For example, Denmark has designated the CPR no. (civil registration no.) as the tax identification number that companies must give to their income payer if they live in Denmark but work abroad.

It can be difficult for some employees to find or obtain their TIN, and some countries may also have long processing times for issuing a TIN. Therefore, our recommendation is that employers ensure they get TIN numbers from their employees as early as possible, to have the information ready to report the payroll for January 2024.

Employees living in an EU country can find details of how to find their TIN on the European Commission website. If the employee resides outside the EU, further details can be found on the OECD website.

Azets can help

If you need advice or assistance, please reach out and we will be happy to help.

Want more information?

You are always welcome to give us a call. If you want us to contact you, fill in the form and we will contact you as soon as possible.

+45 70 232 232