In the wake of Covid-19, many companies have changed the way the conduct business and embraced a more modern workplace model, where employees are no longer required to work from one location. This gives the employees the opportunity to work remotely or from home, which brings both the employer and employee a more flexible and balanced work environment. However, the new way of working also brings a few challenges that companies should take into account.

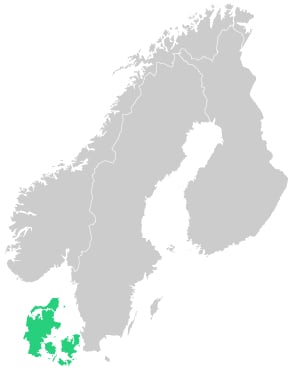

In Denmark, a recent ruling from the Danish Tax Council regarding permanent establishment have shown that foreign companies may be corporate tax liable, if they have any commercial advantage of allowing employees to be located and working from home in Denmark.

Permanent establishment and recent rulings from the Danish tax council

Normally, foreign companies would only become corporate tax liable in Denmark, if the company have a natural presence in the country. This could be if an office, a factory, a shop or another establishment have a location. This practice still applies, however recent binding rulings of the Danish Tax Council has shown that a foreign company could potentially become corporate tax liable to the Danish government if it has an employee working from home in Denmark.

The assessment of whether the employee working from home constitutes a permanent establishment can be determined in two ways:

- There is a commercial advantage connected to the company, when having an employee located in Denmark; Or

- The employee constitute the seat of management of the company or group.

Commercial Advantage

To determine whether an employee, who is not a member of a company’s management board, creates a corporate tax liability, the sort of work and the work’s function within the company structure is taken into account. If the nature of the work does create a commercial advantage for the company with the employee located in Denmark, the company becomes corporate tax liable in Denmark.

For example, if the employee is engaged in sales activities related to the Danish market, and the fact that the employee is located in Denmark is required to fulfill the tasks of the role, the foreign company might have a corporate tax liability.

On the other hand, if the work done by the employee from the home only has a supporting function of the foreign company’s activities and is not limited to the Danish market, then the foreign company might not be corporate tax liable in Denmark. Additionally, if the employee is working from home and living in Denmark because of personal reasons, it could be argued that the company is not liable for corporate tax in Denmark.

CEOs and high-level management

If the employee working from home is a CEO or a member of a management board, the assessment will be based on the position of the employee and the employee’s authority to make overall managerial decisions on behalf of the company. If the employee is a CEO of a group, and has the responsibility of the overall business activities, the CEO being located in Denmark whilst working from home might constitute a seat of management. The company will in that case probably become corporate tax liable in Denmark, even if there is no commercial advantage of the CEO being located in Denmark.

Consequences

If the Danish tax authorities rule that the employee working from home constitute a permanent establishment with respect to corporate tax, it will cause the company to be corporate tax liable on the income related to employee’s business activities in Denmark.

Do you need help with the Danish tax law?

If you have any questions concerning the Danish corporate tax, or general questions about taxation related to the Danish tax code, you are welcome to contact us for more information.

Want more information?

You are always welcome to give us a call. If you want us to contact you, fill in the form and we will contact you as soon as possible.

+45 70 232 232