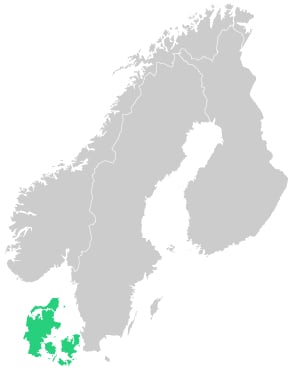

Let Azets assist with Danish tax and VAT

If you have a business in Denmark, you might need help with tax and VAT. If you want to avoid admonishments and reminders from the Danish Customs and Tax Administration, it is very important to stay on top of your VAT accounts and the tax the company has to pay.

Your VAT and tax accounts may end up taking at least twice as long if you are not in control from the start. It is therefore highly advisable to get professional help with Danish VAT and tax, if you do not have the time, inclination or accounting skills yourself.

please call me

What is VAT?

VAT means value added tax and is an additional tax on the sales price of 6%, 12% or 25%. In Denmark, 25% of a product’s or service’s sales price is usually charged as VAT. As a rule, all self-employed people and companies are liable to pay VAT. Very few industries (banking, insurance, health and education) are exempted.

The frequency with which you must settle your VAT depends on your business’s size and turnover. Businesses with an annual turnover not exceeding DKK 5 million must settle their VAT every 6 months.

We help a large number of companies with VAT.

The timing of VAT payments depends on your annual turnover.

The Danish Customs and Tax Administration automatically changes the accounting period at the end of each year if your company turnover changes. If your turnover exceeds DKK 1 million, you have to pay VAT quarterly. In such cases, a change would take effect for the following year. See more deadlines here on the Danish Customs and Tax Administration’s website

The reporting deadlines for declaration of VAT are set out in the following table.

| VAT | Period | Reporting deadline | Limit |

|

Small businesses |

Half-yearly |

1/3 & 1/9 |

Annual turnover below DKK 5 million |

|

Medium-sized and newly registered businesses |

Quarterly |

1/3, 1/6, 1/9 & 1/12

|

Annual turnover of DKK 5-50 million |

|

Large companies |

Monthly |

25 days from the end of the month. For the month of June, however, an extraordinary date of 17 August has been set |

Annual turnover exceeding DKK 50 million

|

Source: skat.dk

What is tax?

Tax is our contribution to public services such as health, education and so on. We all have to pay it, and that applies to businesses as well. How much tax you have to pay and how often as an independent business depends on your type of business.

Personally owned companies have to pay tax every month just like a salaried employee. However, you must make sure that you register your expected income, on which tax is then levied. If you have an ApS, you must pay tax on account twice a year, after which you will receive a final bill.

Finding out how and when to pay tax as an independent business can be a jungle, and you also have to remember to make the most of your allowances! If you are unsure and need help with tax, we are standing by.